An Overview of Green Bonds Pricing Mechanisms

An Opinion on “What’s in a Greenium: An Analysis of Pricing Methodologies and Discourse in the Green Bond Market”

Dina Azhgaliyeva, PhD

Research Fellow, Asian Development Bank Institute (ADBI)

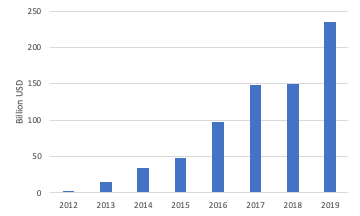

A green bond is a “debt security that is issued to raise capital specifically to support climate-related or environmental projects” (World Bank, 2015). The green bond market grew rapidly from 2012 to 2019 (Figure 1), with US$3.4 billion of green bonds issued in 2012 and US$235 billion of green bonds issued in 2019. The price of a green bond depends on the rates of return of projects as well as on the ratings by issuers. That is why it is important to understand what projects are financed using green bonds and who the issuers are. Globally, green bonds are used mostly to finance renewable energy infrastructure and green buildings. Green bonds are issued primarily by the financial sector, including banks, in addition to governments.

Government policies supporting green bonds can also affect the pricing of green bonds. Some countries started to provide support for the issuance of green bonds. Such green-bond-supporting policies include subsidies or grants that reduce the issuing costs of green bonds by covering the external review costs, which are a mandatory requirement for labeling bonds as “green.” According to Kidney (2017), the costs associated with external reviews represent some of the key barriers at the early stage of green bond issuance. Green bond grants, as well as other policies, potentially could affect the green bond prices. Policies supporting green bond issuance include the following categories according to the Climate Bond Initiative[1]:

- Green Bond Guidelines/Standards

- Tax incentives for issuers and investors

- Public issuance of green bonds

- Grant/Subsidy for green bond issuance

- Boosting demand

- Market development

- Improving the risk-return profile by supporting real sector investments

[1]. https://www.climatebonds.net/policy/policy-areas.

The paper “What’s in a Greenium: An Analysis of Pricing Methodologies and Discourse in the Green Bond Market” provides a review of empirical literature analyzing the difference in pricing between green bonds and conventional, non-green, bonds, as well as practitioners’ views on the pricing of green bonds. The paper would have benefited from further analysis into how future empirical studies could take into consideration practitioners’ opinions. The authors of “What’s in a Greenium: An Analysis of Pricing Methodologies and Discourse in the Green Bond Market” mention the policy implications of studying pricing mechanisms of green bonds. More in-depth research on the benefits of green bonds for issuers, such as lower yields, could ultimately help the promotion of green bonds.

Therefore, future empirical studies on the current topic are recommended in order to establish the role of government policies and practitioners’ opinions on the pricing of green bonds.

Figure 1: Global Green Bond Issuance

Source: Author’s own elaboration using data from Bloomberg terminal.

Biography

Prior to her current position at the ADBI, Dina Azhgaliyeva worked as a Research Fellow in the energy economics division of the Energy Studies Institute, National University of Singapore. She was also a Research Fellow at the Henley Business School, University of Reading, performing empirical analysis of the impact of local content policy on extractive industries. From 2012 to 2015, Azhgaliyeva was an Economics Teaching Fellow at University College London. She also worked as a leading and chief specialist for the Tax Committee at the Ministry of Finance of Kazakhstan for five years. She holds a PhD, master’s, and graduate diploma in economics, all from the University of Essex. She also holds qualifications in teaching from the Higher Education Academy and research career management from the Staff Educational and Development Association.

References

Azhgaliyeva, Dina, Anant Kapoor, and Yang Liu. 2020. Green Bonds for Financing Renewable Energy and Energy Efficiency in South-East Asia: a Review of Policies. ADBI Working Papers Series N1073 Available from https://www.adb.org/sites/default/files/publication/562116/adbi-wp1073.pdf.

International Capital Market Association (ICMA). 2018. Green Bond Principles: Voluntary Process Guidelines for Issuing Green Bonds. ICMA (June). Available from https://www.icmagroup.org/assets/documents/Regulatory/Green-Bonds/June-2018/Green-Bond-Principles—June-2018-140618-WEB.pdf.

Kidney, Sean. 2017. Hot off the Press: Singapore’s Central Bank Announces Green Bond Grant Scheme to Cover Any Additional Issuance Costs of Going Green—What a Way to Kick-Start the Market! Climate Bond Initiative, March 23, 2017. Available from https://www.climatebonds.net/2017/03/hot-press-singapore%E2%80%99s-central-bank-announces-green-bond-grant-scheme-cover-any-additional.

World Bank. 2015. What Are Green Bonds? Report. Washington, DC: World Bank Group.